Understanding Revolving Utilization—A Key to Better Credit Management

What is revolving utilization ?

Revolving utilization, also known as credit utilization or the debt-to-credit ratio, is a critical metric in determining your creditworthiness. It refers to the percentage of your available credit that you’re using on revolving accounts, such as business credit cards. This figure plays a significant role in your credit scores, offering insight into how responsibly you manage your credit. The lower your revolving utilization, the better it reflects on your ability to manage debt, which can positively impact your credit scores.

Revolving utilization is often the primary reason for fluctuations in your credit scores from month to month. Understanding this concept can be challenging, but it’s crucial to grasp how it affects your financial health. According to the FICO score formula, debt is the second most significant factor influencing credit scores, right after payment history. Within this debt category, revolving utilization holds substantial weight. By keeping your utilization low, you can use this knowledge to your advantage, ensuring that your credit scores remain strong and stable.

How Revolving Credit Works

Revolving credit works by providing you with a flexible credit line that can be reused as you pay down your balance. When you're approved for a revolving credit account, such as a credit card, you're assigned a credit limit, for example: $1,000. If you make purchases totaling $200, your balance becomes $200, and your remaining available credit is $800.

As you make payments toward the balance, your available credit replenishes or "revolves" back toward the original limit. This revolving nature allows you to borrow, repay, and borrow again, making it a versatile financial tool for managing expenses. However, it's important to manage your revolving utilization wisely, as it directly impacts your credit scores. Keeping your balance low relative to your credit limit will help maintain a healthy credit profile.

Calculating Revolving Utilization

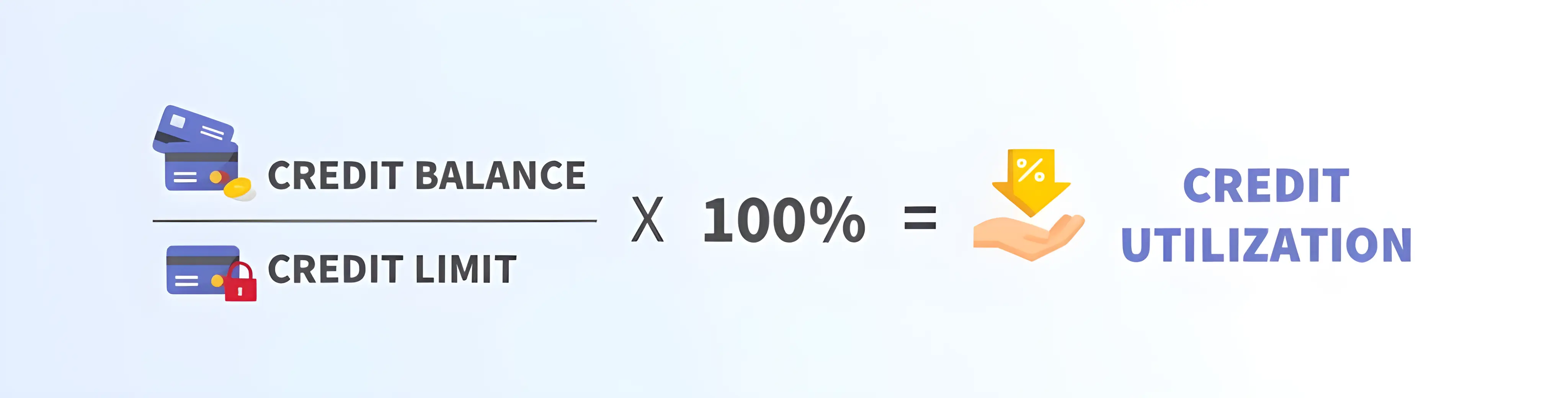

Your revolving utilization rate compares your credit debt to your total credit limit. To calculate it, divide your balance by your credit limit.

Formula: Revolving Utilization Rate = (Credit Card Balance) / (Credit Limit)

Example: If you have a $2,000 balance on a credit card with a $5,000 limit, your utilization rate is 40%.

The revolving utilization rate you see on your credit score is based on all your accounts. So, if you had a second $5,000 credit card with no balance in addition to the card above, your total credit card utilization rate would be 20%.

Your utilization rate is based on revolving credit. So, credit cards and other lines of credit count toward your utilization rate; other types of debt, like mortgages and loans, don’t. Tracking those debts is important for financing decisions, but they don’t factor into your utilization rate.

What Is a Good Revolving Utilization Rate?

A good revolving utilization rate is essential for maintaining a healthy credit score, and all major credit bureaus, including Equifax, Experian, and TransUnion, recommend keeping this rate below 30%. Revolving utilization, also known as debt usage or debt-to-credit ratio, compares the balances on your revolving accounts, such as credit cards, to your available credit. The lower your revolving utilization rate, the better it reflects on your credit management skills.

For example, if your credit card balance is $350 and your credit limit is $1,000, your utilization rate would be 35%. To calculate this, divide the balance by the credit limit and then multiply by 100 to get the percentage. In this case, 350 divided by 1,000 equals 0.35, or 35%. While some articles suggest keeping your utilization rate below 20-30%, the ideal rate can vary depending on your overall credit profile. However, generally speaking, a lower utilization rate typically less than 20-25% is more likely to positively influence your credit scores.

To reduce your revolving utilization rate, consider paying off your credit card balance every month. This not only lowers your utilization but also helps you avoid interest charges and boosts your credit. If paying off the balance in full isn't feasible, you might try increasing your overall credit limit by asking your credit card company for a limit increase or opening a new line of credit. Additionally, keeping old credit cards open, even if you no longer use them, can help improve your utilization rate as long as they don’t carry a balance.

Understanding and managing your revolving utilization rate is key to maintaining strong credit scores and ensuring your financial health remains robust.

Per-Card Utilization vs Total Utilization

Revolving utilization is calculated on both individual revolving credit accounts and across all your revolving accounts combined. Most credit scoring models assess your total revolving balances in relation to the total credit available, making overall credit utilization a crucial factor in determining your credit scores.

Just like one bad apple can spoil the bunch, a single credit card with high revolving utilization can negatively impact your credit scores, even if your other cards have low balances. For example, if you have one card with significantly higher utilization than others and your primary goal is to build or maintain strong credit scores, it's wise to focus on paying down that high-balance card first.

However, if high revolving utilization on one card isn’t affecting your credit scores, there’s no need to obsess over it. When you check your credit scores, you'll typically be informed of the main factors impacting them. If revolving utilization or balances aren't highlighted as an issue, you may not need to take any action.

It's a good practice to regularly check and monitor your credit reports and scores with all three major credit bureaus Equifax, Experian, and TransUnion to ensure your revolving utilization and other factors are in check.

5 Ways to Improve Your Revolving Utilization Rate

It's essential to understand that revolving utilization is calculated based on the balances and credit limits that appear on your credit reports at the time your credit score is determined. Most credit card companies report balances monthly, typically around the time your billing statement closes. You’ll see why this matters shortly.

Also, note that the type of credit plays a role here. Revolving utilization primarily focuses on credit cards and lines of credit, while installment loans, like car loans or mortgages, are treated differently. Home equity lines of credit might be included but not always.

With that in mind, here are six strategies to improve your revolving utilization rate:

- Pay down credit card debt: Reducing your revolving debt balances and keeping them low is a powerful way to improve your utilization. This can quickly boost your credit scores if high debt usage is dragging them down.

- Request a credit limit increase: Increasing your credit limit can improve utilization on individual accounts and contribute to a higher overall credit limit. Most credit scoring models don’t penalize you for having "too much credit available," though VantageScore does consider this factor.

- Open a new credit card: Consider using a balance transfer to a new card to help pay down a credit card with a higher balance. A low-interest rate balance transfer can also save you money on interest.

- Refinance credit cards with a personal loan: Since revolving utilization primarily applies to credit card accounts, using a personal loan classified as an installment account to pay off credit cards can be beneficial. However, there’s no guarantee of success.

- Pay earlier: Remember that most credit card issuers report balances at the close of the billing cycle. If you pay your card around the due date, the payment may arrive too late to reduce the reported balance. To lower the balance reported, consider making a payment online several days before the billing cycle closes.

- Use a business credit card for business expenses: Many small business credit cards don’t report to personal credit unless the debt isn’t paid. This means balances on those cards won’t negatively impact your personal credit scores, although they might affect some business credit scores.

How Opening A Business Credit Card Could Help Your Revolving Utilization?

Let’s delve deeper into an important aspect of revolving utilization for small business credit cards. Many small business credit cards don’t report to the cardholder’s personal credit reports as long as the debt is paid on time. In fact, some cards never report to personal credit at all. However, it's important to note that most small business credit cards still require a personal credit check and a personal guarantee from the cardholder.

Interestingly, while some business credit scores also evaluate revolving utilization, not all of them do. Additionally, business credit reports typically don’t include explicit credit limits. Instead, they often use a recent high balance as a proxy for determining credit usage.

For a detailed breakdown of how different business credit cards report to personal credit, you can refer to a comprehensive chart that outlines this information. Understanding how revolving utilization works in both personal and business credit contexts can help you manage your finances more effectively.

Conclusion

Responsible credit management is crucial for maintaining a healthy financial profile, and a key component of this is keeping your revolving utilization in check. By understanding how revolving utilization impacts your credit and managing it wisely, you can significantly improve your credit health and overall financial well-being.

A healthy credit score not only reflects good financial habits but also opens doors to better loan terms, lower interest rates, and greater financial stability. By consistently monitoring and managing your revolving utilization, you can ensure long-term financial success and security.

FAQs

Q. How does revolving utilization impact my credit score differently on individual credit cards versus total credit usage?

Revolving utilization affects your credit score by assessing both individual credit card balances and the total balance across all your revolving accounts. If one credit card has a high utilization rate, it can negatively impact your overall credit score, even if your other cards have low balances. It's important to monitor both individual and total utilization to maintain a strong credit score.

Q. Can opening a new credit card improve my revolving utilization rate?

Yes, opening a new credit card can improve your revolving utilization rate by increasing your overall available credit. This can lower your utilization percentage, especially if you transfer balances from cards with high utilization. However, be mindful of the potential impact on your credit score from opening new credit accounts.

Q. Why is it important to pay off credit card balances before the billing cycle closes?

Paying off your credit card balances before the billing cycle closes can lower the balance reported to credit bureaus, which in turn improves your revolving utilization rate. Since most credit card companies report balances at the end of the billing cycle, paying early ensures that a lower balance is reflected in your credit reports, positively influencing your credit score.